The current market set-up and drama surrounding the Federal Reserve (the Fed) is center stage right now and about as Shakespearean as it gets. In this unfolding monetary policy play, Fed Chairman Jerome Powell is seemingly cast in the role of Hamlet. Taking some license with that famous soliloquy in the actual play, the poetic script running through Powell’s mind, in this hypothetical, might read something like this:

“To cut or not to cut?

Whether ‘tis nobler in mind to suffer the slings and arrows of a weakening labor market

Or to take arms against a sea of seemingly rising inflationary pressures…

That is the question!”

The Fed policy plot was already tenuous earlier this year, when the headlines about the U.S. Central Bank focused on investors’ speculation over when the Fed should begin to ease and whether it had waited too long to adopt a more accommodative interest rate stance.

Earlier calls for Powell’s resignation by the President had started to die down by July, but they resurfaced following the softer July payroll report that was released in early August. The lackluster figure of only 73,000 new job gains in July, coupled with the negative employment growth revisions for May and June, suggested the labor market and broader economy were slowing more significantly.1

The Fed—which held its scheduled monthly meeting on July 30 to decide whether to cut rates or hold steady—had to make their decision two days before this disappointing August 1 payroll growth release and weeks ahead of other key inflation data still to come. Once the core Consumer Price Index (CPI) and Producer Price Index (PPI) data were released in late August, they revealed that inflation has begun to run hotter than hoped.

As a result, it’s not surprising to us that the Fed kept rates unchanged on July 30, given the facts available at the time: employment conditions overall were slowing but still healthy, while inflationary pressures were modestly rising and inching-up considerably above the Fed’s 2% inflation target.

Further, the negative revisions for May and June payroll data weren’t especially startling, given the understandable temporary stall in CEO confidence and in businesses’ hiring plans during those months, when tariff threats were at peak-ish levels.

That said, the Fed’s hold’em steady decision, combined with the disappointing Aug. 1 labor market data, was not well received by some. Quite the contrary: The July 30 “do nothing” call by the Fed set off a wave of criticism by the President and his administration.

The negative revisions to prior months’ job gains and the weaker July payroll report fueled frustration with the Fed’s stance. Critics pointed to Powell’s perceived slowness in moving toward rate cuts—something the administration argues is necessary to support continued growth.

There have also been renewed calls by the administration questioning Powell’s leadership, with speculation about attempts to remove him. Since it’s not lawful to dismiss a Fed Chair simply for resisting pressure to cut rates, discussion in the media briefly centered on other potential justifications, including alleged cost overruns tied to renovation projects at Fed headquarters.

It bears repeating that the Fed Chair is duty bound not to yield to political pressure. His or her responsibility is to act independently, based on fact and not external pressure. In the end, these stories were widely viewed as an inappropriate way to challenge Fed independence and shift control away from the current, more moderate policy stance embraced by the majority of the Fed committee.

If this wasn’t enough drama for investors and Fed watchers, when the construction-related story lost steam in the headlines, other ideas surfaced in the press suggesting ways to wrest control from the Fed’s interest-rate decision-making responsibilities. To many long-time financial market spectators, these alternative strategies felt baseless and even somewhat troubling.

One such story involved speculation about the possible removal of a more hawkish leaning member of the Federal Reserve interest rate decision-making committee. Legal challenges have since been mounted, and the matter will appropriately play out in the courts. For now, the muted reaction in bond yields suggests the market expects little near-term change to the Fed’s decision-making structure through these efforts.

It’s natural that many outside the Fed prefer lower rates—after all, easier credit can make economic conditions stronger, at least temporarily. We understand this. Further, we want to make the point that it’s perfectly reasonable for non-Fed constituents—members of Congress, the Executive Branch, Wall Street, etc.—to express public opinions on where rate policy should go.

What’s different, however, is an attempt to wrest responsibility from the Fed and push it to set policy based on political expediency rather than the data. The Fed must base its decisions on what’s best for the economy in the committee’s view. At present, it’s rather difficult to make a strong case for aggressive rate cuts when inflation is starting to run hotter and unemployment remains near historic lows.

Even so, the Fed is facing overwhelming and unconventional types of pressure to do just that—significantly cut rates. Efforts to change the make-up of the members of the committee, however possible, to achieve a more dovish stance in monetary policy, push the envelope on methods to accomplish this.

This has created multiple dilemmas for the Fed, echoing the twists and turns of a Shakespearean drama. In a nutshell, these unprecedented events feel strikingly similar to the tangled plots of Shakespeare’s Hamlet.

Foremost in Shakespeare’s play are Claudius’ plans to murder Hamlet’s father, assume the throne and marry Hamlet’s mother. Hamlet struggles to reconcile his desire to avenge his father’s death with his instincts to maintain high moral character—he does not want to commit murder, even in the face of his uncle’s heinous act.

In a similar vein, Fed Chair Powell must navigate challenges directed at him and his committee while carrying out the critical mission of fostering economic, price level and financial market stability. At the same time, he must preserve the broad desire for the Fed to maintain its historical independence from outside influence.

Along these lines, if the Fed cuts too much, too soon, this could have the opposite effect as hoped for by the more dovish inclined. Ironically, it could also cause mortgage rates and longer bond yields to soar. This would be disastrous for stocks and bonds. A slow, data dependent approach to interest rate policy determined by an independent Fed unencumbered by political considerations seems wise to us.

This doesn’t have to be a tragedy, but clearly there are tricky challenges and navigational options to study that entail serious financial market impacts we must consider. At minimum, the Act 1 nature of these events only affirm our theme of “Clear Air Turbulence” and heightened price volatility we envision throughout 2025, despite the fact that we believe the play will have a happy ending.

Is a September Fed Cut a No Brainer? Scenarios to Consider

Even though Fed futures pricing (which reflect the market’s expectations of Feds Funds Rate changes) as of Sept. 2 suggests there is over a 90% chance that the Fed will cut in September, we don’t think a cut then is a given.2 It’s certainly not a no brainer. As mentioned above, we’ll get more important labor market and inflation data before the Fed meets.

The Fed, in our view, has plenty of rationale to continue to hold rates steady if this data suggests that a scenario exists where the employment data is remaining stubbornly healthy whilst inflation is rising. If they execute a preordained cut, despite a lack of rationale or support via the trend in these metrics, we think such action creates the greatest risk.

Specifically, it risks a sharp rise in mortgage rates and intermediate bond yields, either soon after or with a lag. This is exactly the opposite outcome the administration is seeking to achieve via its sought-after rate cut that it’s boldly championing.

Interestingly, the immediate news of such a cut, under these prevailing circumstances, could be cheered by investors at first blush and could cause a temporary rally or melt-up in stock prices. Ultimately however, we would expect the bond vigilantes to surface in this setting and eventually ignite a meltdown in equities.

Instead, should the Fed decide to remain on the sidelines—given a resilient economy but stubborn levels of inflation described above—and wait until the data clearly supports a cut, that would be most welcome. Such an approach would also be consistent with our base case expectations for further reasonable gains in stock prices.

On the other hand, should the employment and general demand-oriented data deteriorate further in upcoming reports while inflationary pressures ease, the Fed would indeed have the green light to reduce rates beginning in September. This would be a data-dependent decision, not a pressured or preordained one. It would be appropriate to cut under such conditions and provide support to the economy and market.

Clearly, we are simply agreeing with current Fed leadership and leanings that a fact-based approach to making interest rate calls is the right side of valor.

Let’s remember that fed funds futures and market pundits were implying and clamoring for six to seven rate cuts in 2024 and warned that if they didn’t happen early in the year, we would have a massive recession and market meltdown. In reality, we only got three cuts in the entire calendar year, and the first one didn’t happen until the month of September. The Fed listened to the data and responded appropriately. Result? No recession and stock market returns of over 26%!

Wrap-Up…Is this Market Rally Based on More Than Hopes for Fed Rate Cuts?

Yes! Arm-chair quarterbacking can cause all kinds of temporary volatility and short-term psychological moves in the market, both to the upside and downside. There’s a lot of that going on right now that could cause some whiplash in investor moods.

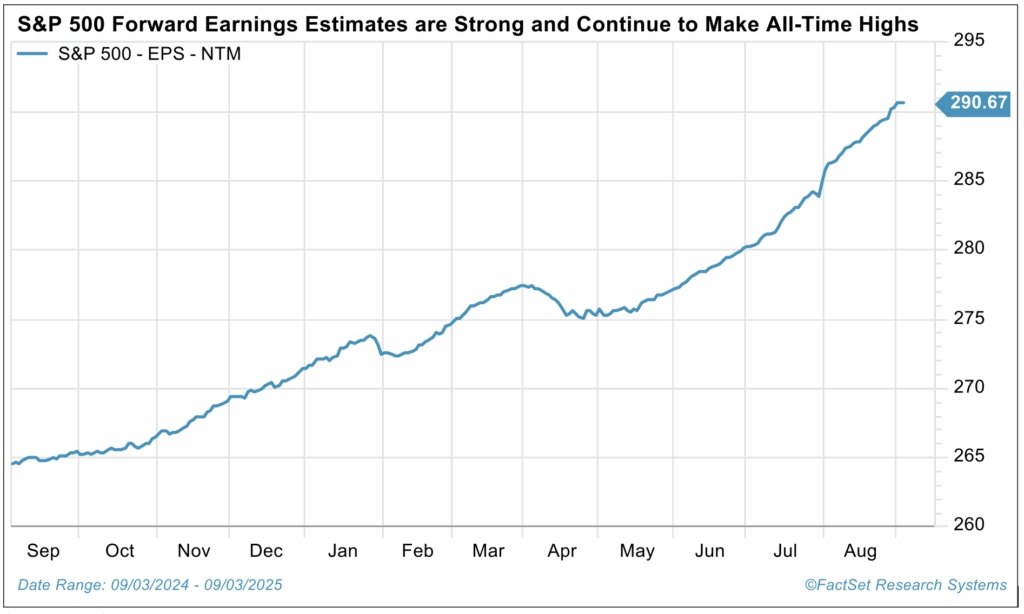

To avoid whiplash in client returns, we rely on FVT (Fundamental, Valuation and Technical) trends. They are constructive at present. Second quarter earnings growth of 13% YOY was almost three times better than expected, with earnings beats stronger than we’ve seen in some time. Earnings contributions were broad and not just technology based. Margins are at record highs. Forward earnings figures are solid and are also at record highs.

The US economy looks to be growing at a 2.2% annualized clip in the third quarter per the Atlanta Fed. It’s these fundamentals that drive our constructive equity outlook, not simply our expectations for accommodative fed policy before year end. In this environment, our “Hold Your Ground” and “Clear Air Turbulence” themes remain as relevant as ever. We still expect to land safely at our forecast destination but with more drama and bumps along the way.

Sources:

1 “Bureau of Labor Statistics”

2 “CME FedWatch Tool”

This commentary is provided for informational and educational purposes only. As such, the information contained herein is not intended and should not be construed as individualized advice or recommendation of any kind.

The opinions and forward-looking statements expressed herein are not guarantees of any future performance and actual results or developments may differ materially from those projected. The information provided herein is believed to be reliable, but we do not guarantee accuracy, timeliness, or completeness. It is provided “as is” without any express or implied warranties.

Equity securities are subject to price fluctuation and investments made in small and mid-cap companies generally involve a higher degree of risk and volatility than investments in large-cap companies. International securities are generally subject to increased risks, including currency fluctuations and social, economic, and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

Fixed-income securities are subject to loss of principal during periods of rising interest rates and are subject to various other risks including changes in credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications, and other factors before investing. Interest rates and bond prices tend to move in opposite directions. When interest rates fall, bond prices typically rise, and conversely, when interest rates rise, bond prices typically fall.

There is no assurance that any investment, plan, or strategy will be successful. Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results, and nothing herein should be interpreted as an indication of future performance. Please consult your financial professional before making any investment or financial decisions.

The S&P 500 is a capitalization-weighted index designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is unmanaged and cannot be directly invested in.

Investment advisory services are offered through Investment Adviser Representatives (“IARs”) registered with Mariner Independent Advisor Network (“MIAN”) or Mariner Platform Solutions (“MPS”), each an SEC registered investment adviser. These IARs generally have their own business entities with trade names, logos, and websites that they use in marketing the services they provide through the Firm. Such business entities are generally owned by one or more IARs of the Firm, not the Firm itself. For additional information about MIAN or MPS, including fees and services, please contact MIAN/MPS or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Registration of an investment adviser does not imply a certain level of skill or training.

Material prepared by MIAN and MPS.